Before teller terminals, there was DOLLIE

With the click of a few buttons, tellers today can pull up customer account information in seconds, but it was not always that way.

Bankers initially kept customer records in large books and ledgers, locked up safely on site. As banks began opening branches, customer records continued to be decentralized with each branch keeping its own records. If a customer went to a different branch, a teller would call their regular location to verify information and account balances.

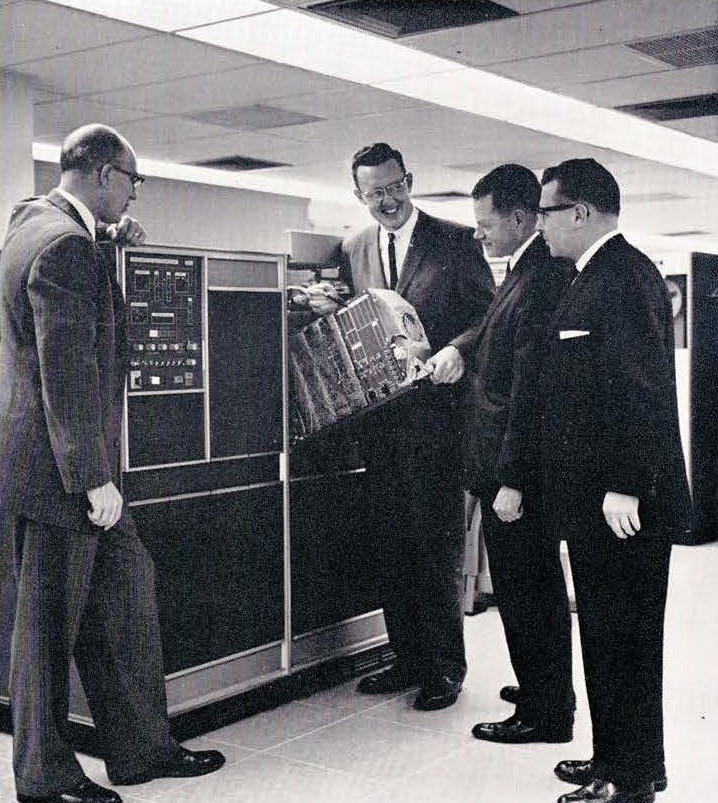

In 1961, Wells Fargo opened its first Operations Center to create one centralized location for all customer accounts. With five state-of-the-art computers, the Operations Center could process 100,000 checking accounts, 115,000 consumer loans, and trust department accounting.

With customer accounts removed from branches tellers needed a way to quickly access customer account information. Enter DOLLIE—the first computer system designed for tellers at Wells Fargo.

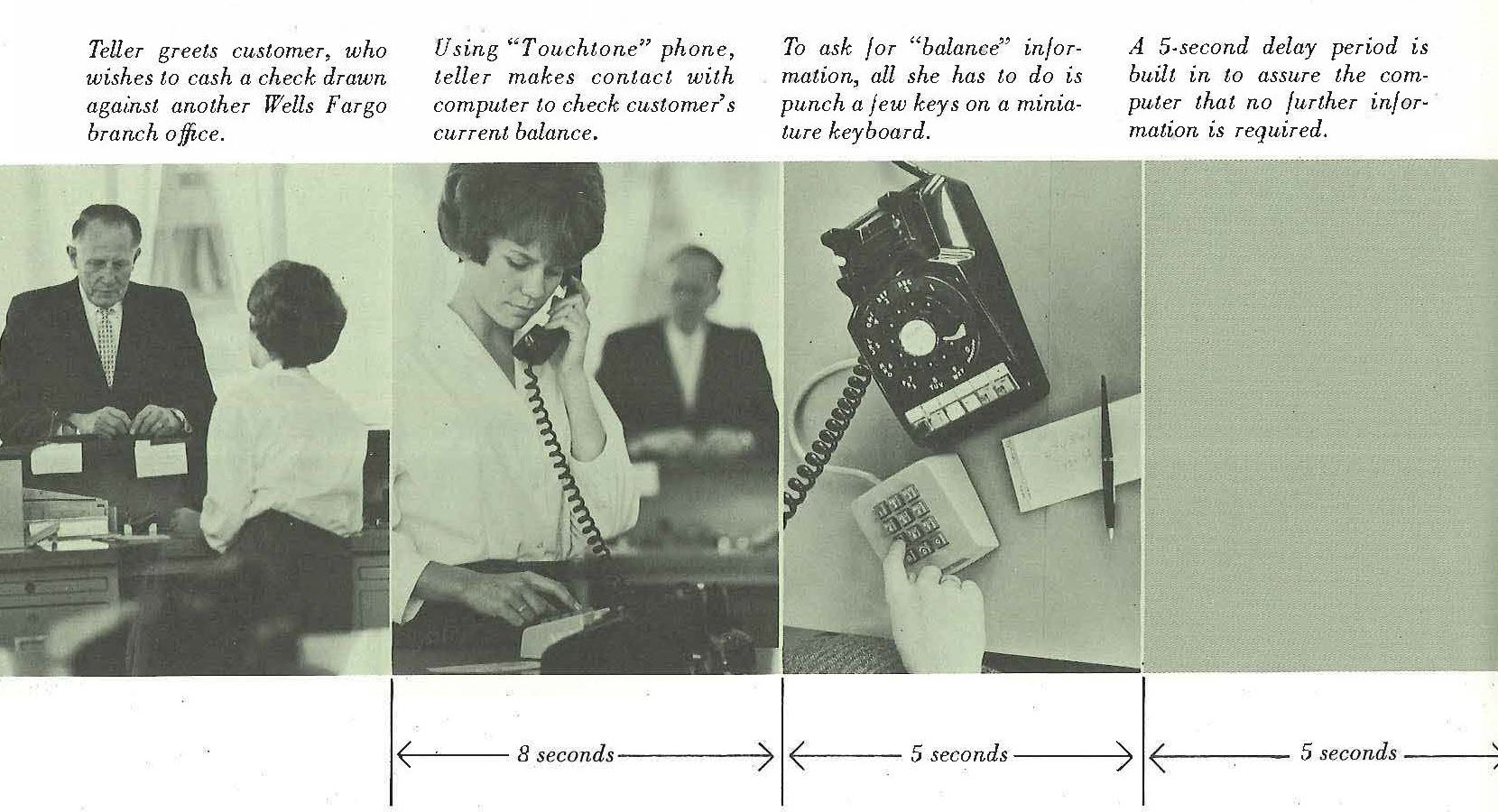

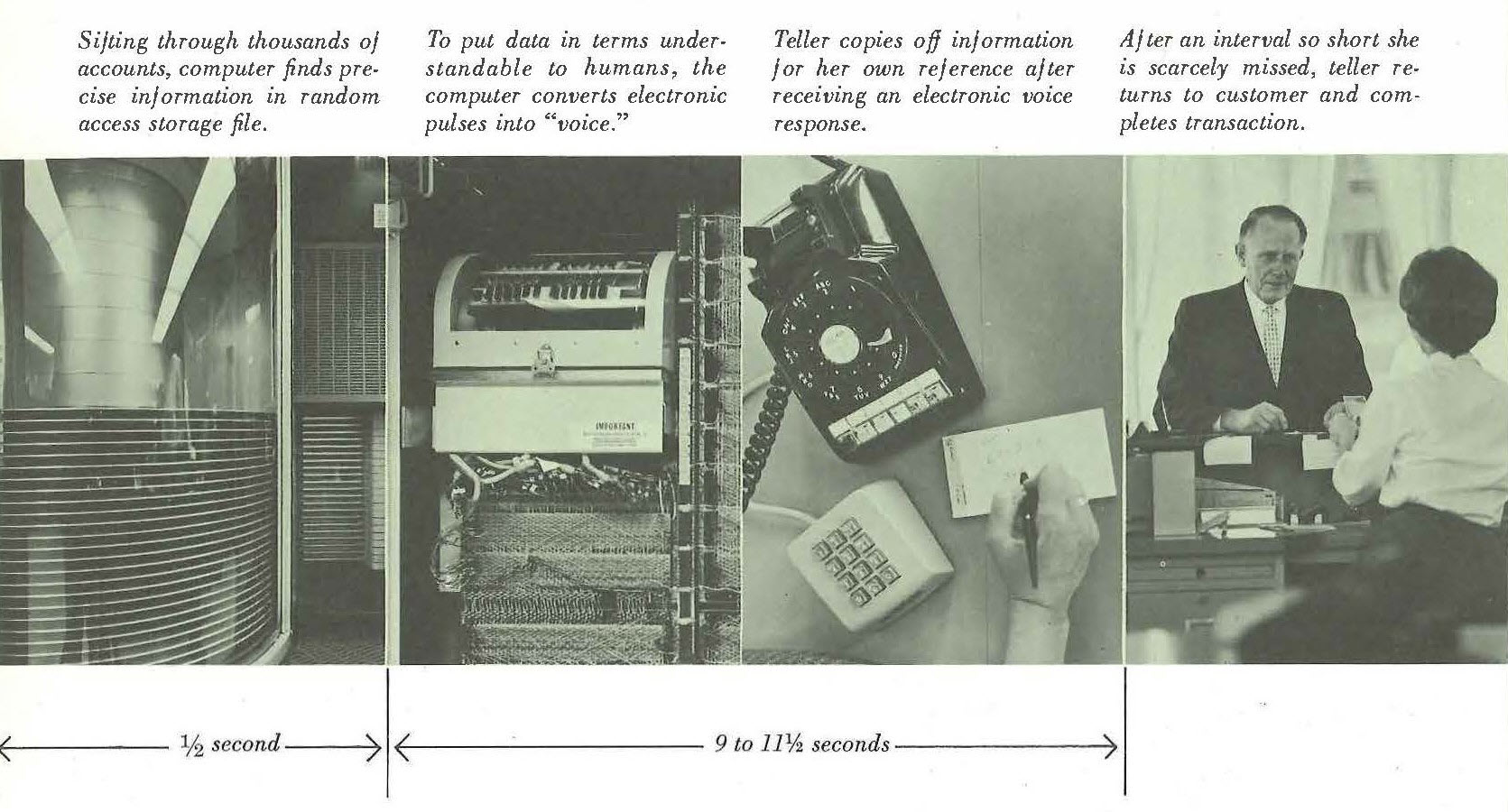

The Direct On-line Ledger Inquiry Equipment (DOLLIE) was a network using a telephone line between the branches and the Operations Center. Using a touchtone keypad and phone, tellers would enter in the customer account number and a few other codes. DOLLIE would electronically look up the account in the centralized records, and “tell” the banker the answer 30 seconds later. Alternatively, tellers could type the account number and codes into a special keyboard connected to the phone line. DOLLIE would send back a typewritten response.

While it might seem quaint today, DOLLIE was the opening act to a dramatic revolution. As bank officials explained, DOLLIE was the first equipment of its kind and “a clear indication of our big lead over other California banks in the field of automation.”

A lot has changed since the 1960s. Computers evolved from mammoth machines to a feature of every teller window and part of everyday living. Across time, Wells Fargo has leveraged innovative technology to improve the banking experience for customers on the go.