Yesterday’s revolutionary form of currency

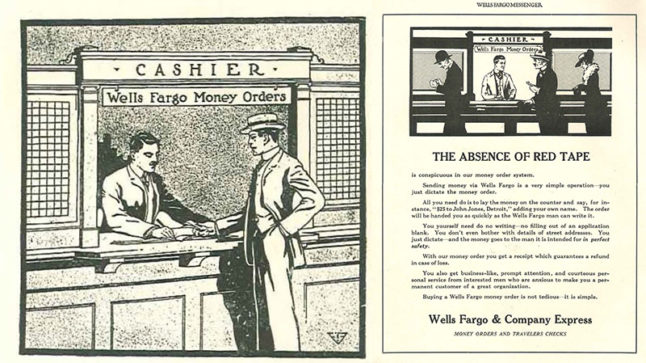

Pieces of paper with handwritten signatures and scrawled instructions hardly seem on the cutting edge of financial innovation. But they were a revolutionary form of currency in the late 1800s and early 1900s, and Wells Fargo helped bring them to people across the U.S.

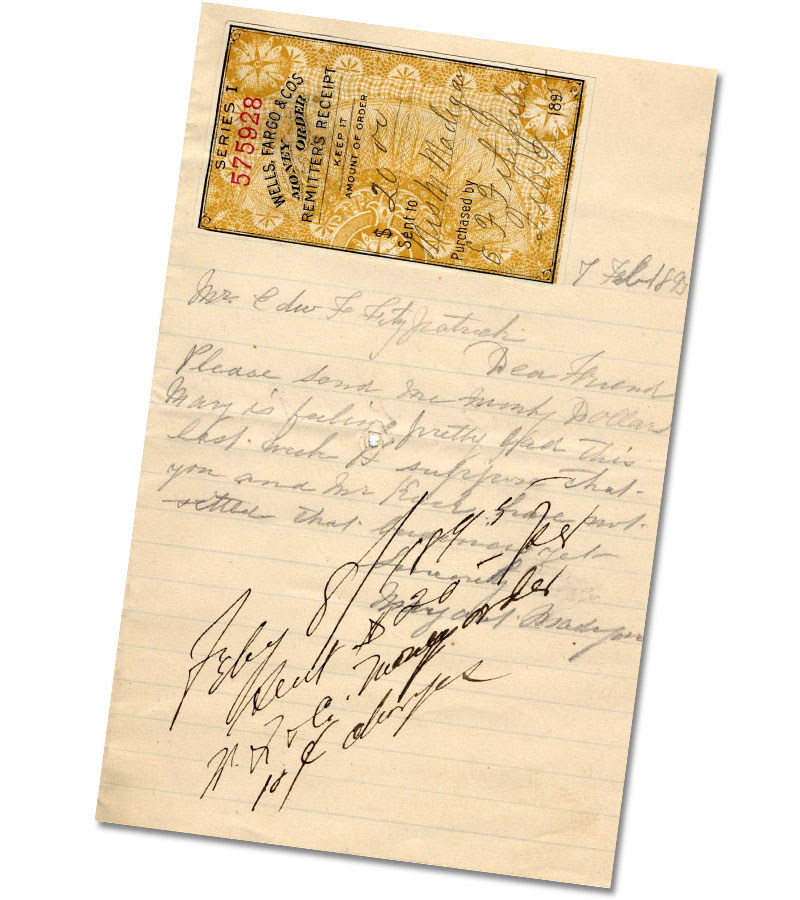

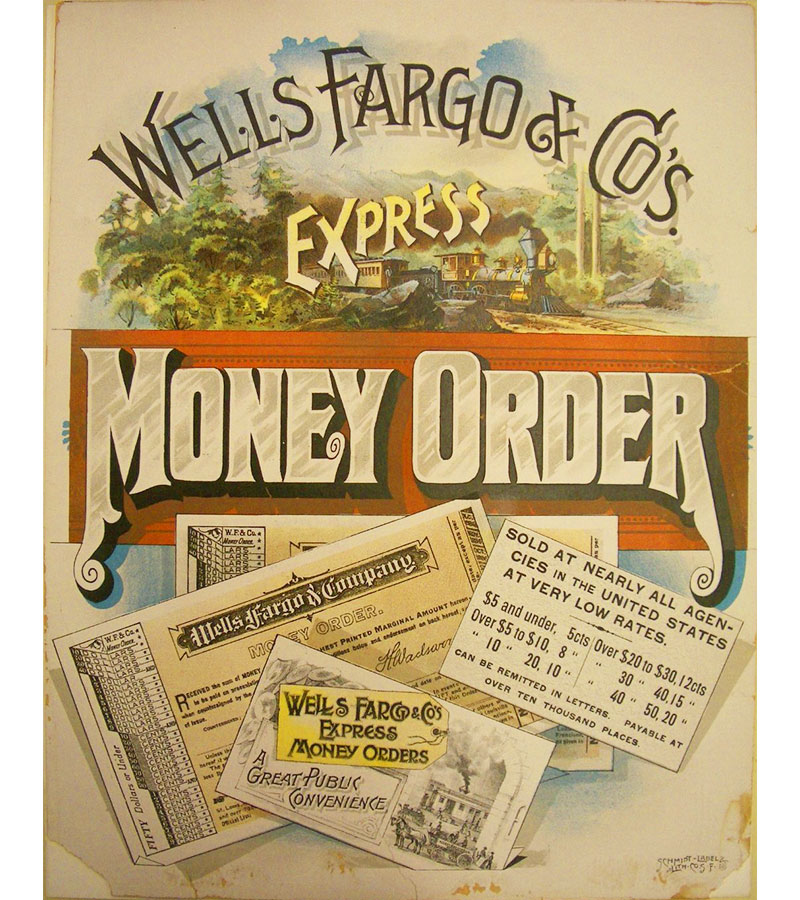

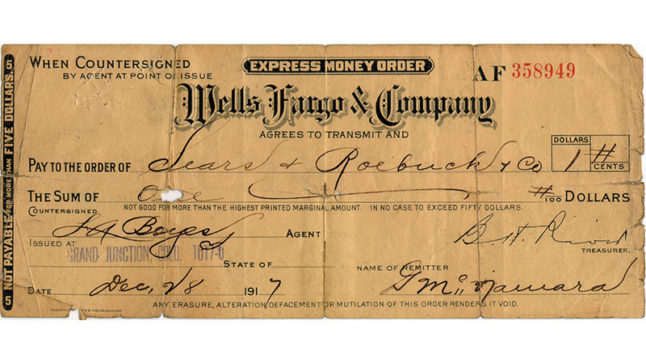

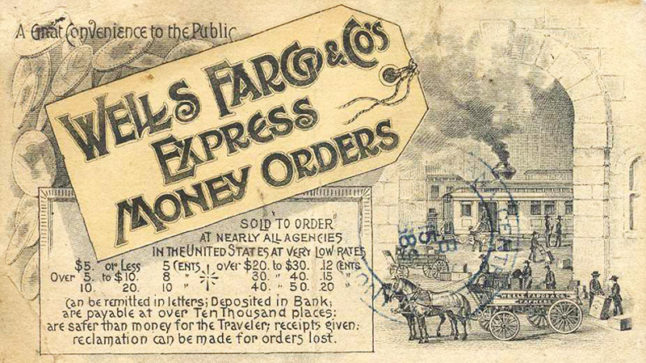

Money orders were first issued in large cities and towns by the U.S. Postal Service in 1864. People could help friends and family who needed money quickly, pay bills, and buy things from catalogs with money orders. They allowed people to exchange cash for a replaceable piece of paper that could only be used by a specific person or company, much like a check. While today checks from one bank are usually accepted at another, in the past that was not always the case. Many banks and stores refused to accept a check from an unknown institution. Money orders, however, were easily exchanged and widely accepted.

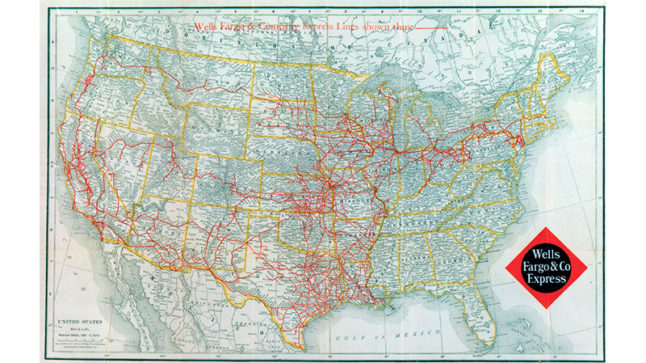

The universal use of money orders originated from an agreement between Wells Fargo and other express companies to accept money orders issued by their competitors. People could walk into any Wells Fargo office and exchange a money order from another company for cash. This created a national network of locations where people could buy a money order with the confidence that it was worth the amount written on the paper everywhere in the country. Between 1885 and 1916, people purchased 55 million Wells Fargo money orders that helped them exchange $500 million.

Merchants recognized the utility of the new payment system and built mail-order businesses that revolutionized how people shopped. With a piece of paper, people could buy the latest fashions from department stores in New York and home furnishings from stores in Chicago — all without leaving their towns. Money orders changed more than how people transferred funds; they changed people’s daily lives and expectations.

The history of money orders shows that innovation isn’t always the act of an individual; it often results from cooperation and collaboration. In 2017, Wells Fargo partnered with Early Warning Services to provide Zelle®, a new way for our customers to send, request and receive money with people they know. In 2023, consumers and small businesses sent 2.9 billion transactions totaling $806 billion. Zelle® enables them to send and receive money via desktops and smartphones with people they know who have a bank account in the U.S. — with funds typically available within minutes between enrolled users. While the exchange of money has evolved over the years, cutting-edge innovation continues today.

Wells Fargo Bank, N.A. Member FDIC.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.