Dispensing money like magic

Wells Fargo currently has more than 11,000 automated teller machines (ATMs) that are known for leading the industry in technology and customer service. Today, customers can even access their money without plastic cards — using just their smartphones and a one-time access code. But it wasn’t always as convenient.

In the summer of 1967, Barclays Bank unveiled its first automatic cash machine at a suburban London branch. This early version of the ATM dispensed money to customers who obtained paper vouchers in advance from tellers. Customers inserted the vouchers into the machine and received cash in exchange.

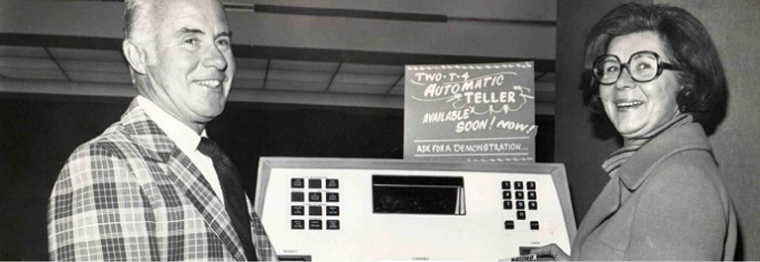

Wells Fargo and many other banks soon began testing this new machine technology as a way to deliver convenient, 24/7 banking access. For customers holding a plastic ATM or debit card, the machines dispensed money like magic. But back in the ’60s, banking by machine instead of at the teller window was a new experience for most.

Many bank customers were a little apprehensive at first. Banks stationed employees at the machines to demonstrate their use and explain the security features of an ATM card and personal identification number. Some banks even gave their ATM a first name and friendly personality so customers would not feel intimidated when they used the machine. One of the most successful early ATM marketing programs introduced “Tillie the All-Time Teller” to First National Bank of Atlanta customers.

Testing out Wells Fargo ATMs

In July 1970, Wells Fargo began testing its own “Self Serv Teller” at a few branch locations. This cash-dispensing machine was activated with either a special magnetic-striped card or credit card to allow cash withdrawals in amounts of $25 or $50. To test customer acceptance, Wells Fargo even experimented with a machine that dispensed coins.

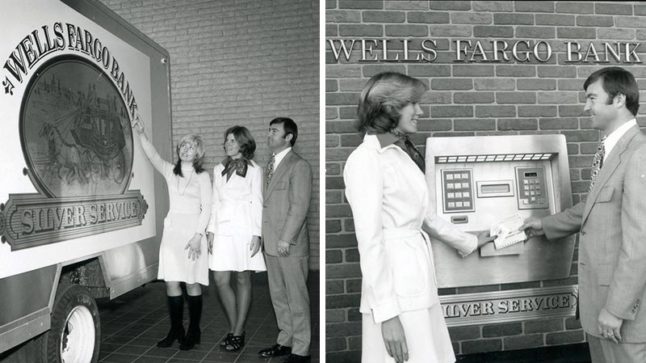

By 1974, Wells Fargo tested a first generation of ATMs — called “Silver Service” — at several branches in California. These machines offered greater convenience by allowing customers to make deposits or loan payments in addition to obtaining cash — and all that was needed was a plastic card and a secret, personalized code.

Wells Fargo planned to install ATMs at 160 branches over eight years — at a cost of an estimated $48,000 per machine — anticipating an increase in deposit accounts by customers who embraced the convenience of ATM banking. Retail bank management decided to call their first batch of 10 ATMs a test so as not to alert competitors to plans for a larger-scale rollout of the machines. Bankers at the time felt the future of the automated teller machine was still uncertain. “If we experience total failure and remove the machines after six months, we will have spent $1.8 million,” concluded retail bank planners pitching the ATM proposal to bank executives in a 1976 memo.

A successful experiment.

The ATM experiment did not fail. In fact, it was a great success and the machines were well-received by customers, according to the company’s 1976 annual report. In 1978, Wells Fargo unveiled a new generation of its branded ATMs called the “Express Stop” in 10 branches east of San Francisco, and began quickly building out its network of ATMs statewide the following year. By 1981, Wells Fargo Bank had 208 express stops up and running in California.

Over the years, Wells Fargo’s ATMs have become available throughout the U.S., and today they even support communities by allowing customers to donate to select nonprofits and American Red Cross relief efforts through them. In March 2017, Wells Fargo became the first major bank in the U.S. with an entire fleet of card-free ATMs with its one-time access code technology. Since then, customers have conducted more than one million card-free transactions. Wells Fargo looks forward to paving the way for new technology and better customer service.