Funding a solar revolution

In the 1950s, commercial solar silicon photovoltaic (PV) cells came onto the market. For the first time, the sun powered satellites, radios, and even heating systems. Despite these early successes, the expensive and novel technology did not inspire an immediate energy revolution.

That changed dramatically with the energy crises of the 1970s. The U.S. had about 6% of the world’s population, but used 30% of the world’s energy, and that demand kept growing. As limited supply and greater demand led to price spikes, President Richard Nixon started price controls in 1971 to create artificially affordable gas, however, his domestic policies could not influence the International market.

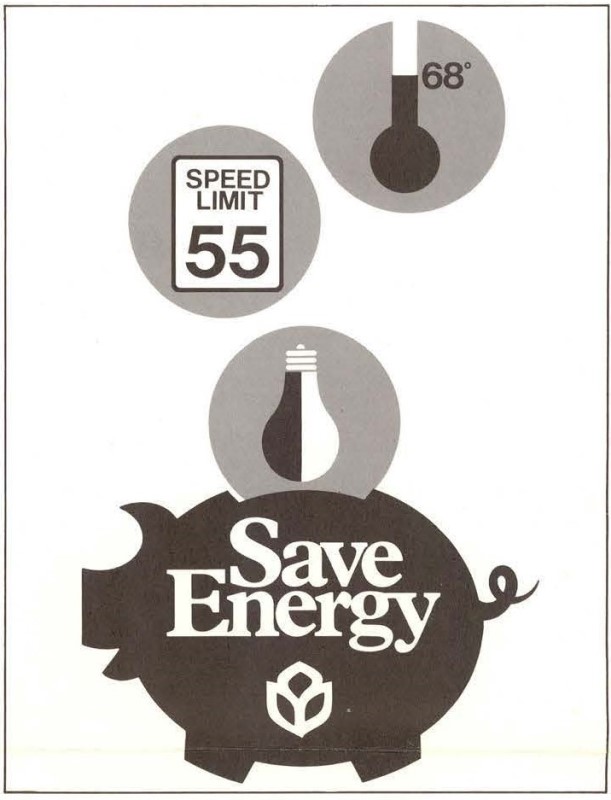

America had ceased being an exporter of oil in the 1950s, and depended on imports for about one-third of its energy by the 1970s. In 1973, the U.S. allied in support of Israel during the Yom Kippur War. The Arab members of the Organization of the Petroleum Exporting Countries united to retaliate with an embargo on oil exports. The cost of a barrel of oil jumped immediately from $3 to $12. Gas stations closed as cars lined around the block to fill their tank. Families bought sweaters and dropped their home heating thermostats to a recommended 68 degrees. The first federal speed limits were posted on the nation’s highways to reduce unnecessary speed and gas usage.

The first embargo lasted only five months but resulted in years of additional disruptions, brownouts, gas shortages, and fear. The crisis deepened with another embargo following the 1979 Iranian Revolution.

At the same time, Americans debated the impact of energy production as the early environmental movement took shape. People searching for cleaner air and water organized and helped create the first federal regulation of pollution. Concerned citizens gathered to celebrate the first Earth Day on April 22, 1970.

Growing environmental activism ensured that the U.S. would invest in green energy alternatives as it looked for solutions to the energy crisis. Government grants funded research projects, and the state and federal tax deductions encouraged a revolution of energy efficiency. Private investment from banks like Wells Fargo offered additional momentum.

Investing in early technologies

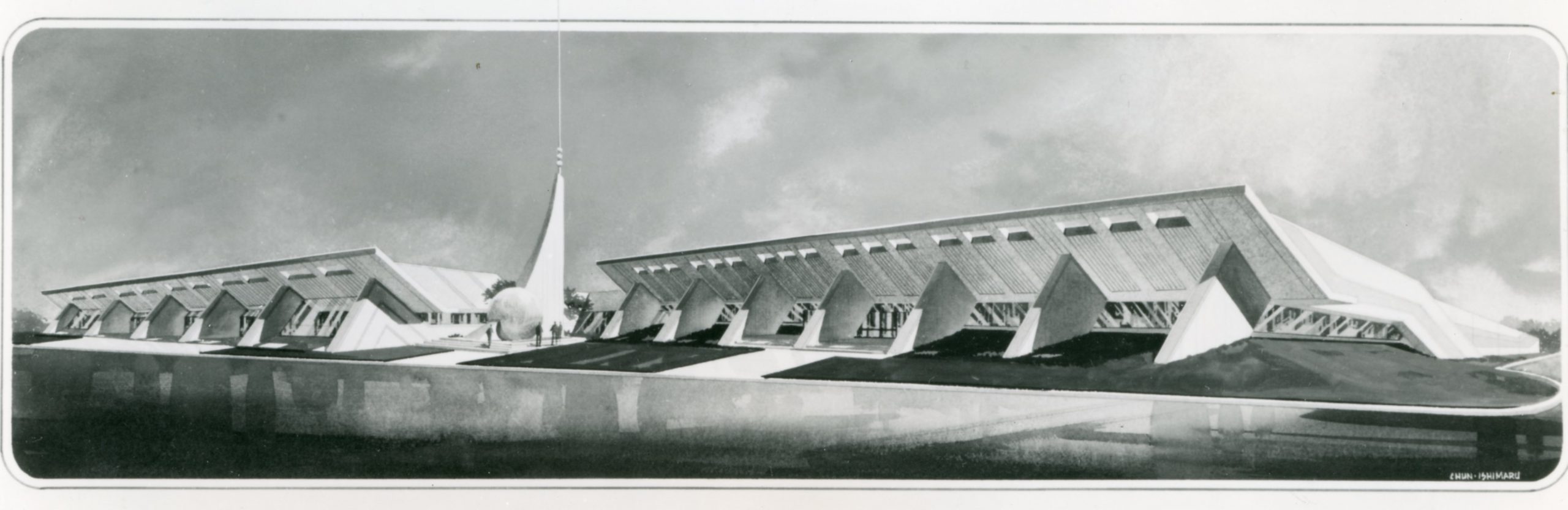

In 1976, developers in California’s Silicon Valley wanted to be part of the green energy movement. After learning that about 30% of domestic energy use came from space heating, the developers sought a better solution with a solar-powered heating and cooling system for a new project.

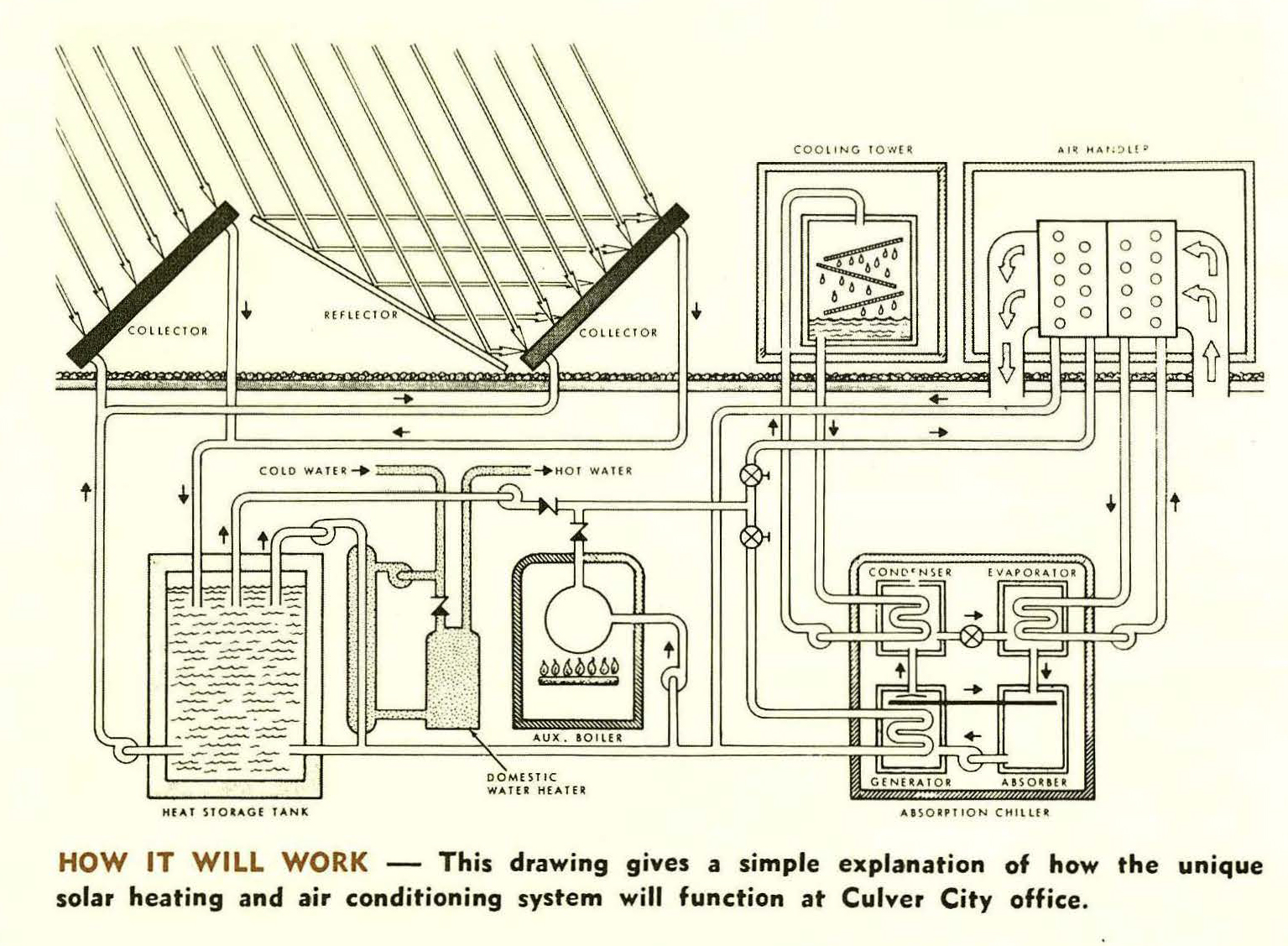

Many homes today use solar panels as an alternative to the electrical grid. But technical limitations at the time turned heating and cooling into the most popular use of solar power. These thermal solar systems used the heat of the sun to warm water circulated through panels in copper tubes. Sophisticated air control systems manipulated the resulting air currents to make a building warmer or colder.

While some industrial plants had retrofitted buildings with solar-powered heating, the Silicon Valley developers planned to utilize solar from the start, making it possibly the first solar system planned for a new commercial building. At more than 100,000 square feet, it was also believed to be the largest industrial use of solar in the U.S. at the time. While many banks considered solar a risky investment, Wells Fargo provided $2 million in construction loans to the project — more than $11 million adjusted for inflation in 2023. The building opened in 1978 to national attention as representative of a new era in American architecture.

Since then, the solar industry has continued to evolve. Technology has become more efficient and more affordable, even resulting in energy surpluses. Wells Fargo has continued to invest in renewable energy projects.

Solar at Wells Fargo

Just as families and communities faced difficulties during the energy crisis, Wells Fargo and other banks saw their operations costs skyrocket. Companywide conservation drives turned off signs and lowered heat. From 1973 to 1974, Wells Fargo reduced its energy use by 24%.

Meanwhile, the Corporate Responsibility Committee at Wells Fargo set goals for greener alternatives. In 1979, Wells Fargo installed a solar heating and cooling system as a test at a branch in Culver City in sunny Southern California. As the property manager said at the time, “You can talk theory forever, but until you actually try it, you don’t really know how effective it will be.”

The branch used an array of 840 square feet of solar panels to heat water in copper tubes. Glass walls ensured that customers could see the $48,000 solar thermal system at work. As solar technology continued to evolve, Wells Fargo continued experimenting with solar systems and renewable energy.

The Environmental Protection Agency recognized Wells Fargo as the nation’s largest purchaser of Renewable Energy Certificates in 2006, the same year the company launched a business focused solely on providing financing to renewable energy projects. The company made a sector-leading renewable energy commitment in 2016, and began meeting 100% of its global electricity requirements with renewable energy the following year.

Today, Wells Fargo maintains a number of solar powered ATMs, solar arrays on 16 properties and has announced plans to bring on-site solar generation to close to 100 new branch and corporate buildings.

Wells Fargo solar timeline

2005

Wells Fargo announced a 10-point Environmental Commitment that included the company’s first sustainable finance goal: $1 billion in lending over five years to green companies.

2006

The Environmental Protection Agency recognized Wells Fargo as the nation’s largest purchaser of renewable energy certificates.

Wells Fargo organized a volunteer network, called Green Teams, to enable employees to promote environmental stewardship in their communities.

2009

Wells Fargo installed solar panels at 10 branch locations in Colorado.

2011

Environmental investments in green businesses and renewable energy projects from 2005 to 2011 totaled $11.7 billion.

2013

Wells Fargo employees requested EV charging stations at the bank’s campus in Des Moines, Iowa. This grassroots effort led to more charging stations installed at several campuses across the U.S.

2014

Wells Fargo and the U.S. Department of Energy’s National Renewable Energy Laboratory launched the Innovation Incubator (IN2) program. This environmental grant program was designed to accelerate the development and commercialization of early-stage clean technologies and foster a clean technology ecosystem.

2015

Projects owned in whole or in part by Wells Fargo produced more than 10% of all solar photovoltaic and wind energy generated in the U.S.

2017

Wells Fargo met 100% of its global electricity requirements with renewable energy sources. The company accomplished this through a combination of on-site solar, offsite renewable energy contracts, and the purchase of renewable energy certificates, or RECs.

2018

Wells Fargo made a $200 billion sustainable finance commitment through 2030, with at least 50% going toward renewable energy and clean technology projects.

Wells Fargo also provided $5 million in seed funding to support solar projects in tribal communities.

2019

Wells Fargo maintained solar arrays on 16 corporate properties.

The bank entered into a subscription agreement with Salt River Project Agricultural Improvement and Power District (“SRP”) to receive 6.1 megawatts output of a new 100-megawatt solar project located in Pinal County, AZ, which will meet 28% of its electricity needs in the SRP Arizona footprint. Wells Fargo announced a renewable energy transaction that will power 400 Wells Fargo properties in Texas from a new utility-scale solar installation in the state. It is the first major transaction under the second phase of the company’s renewable energy goal — to transition from purchasing RECs to entering into long-term contracts that support the development of net-new renewable assets located near its load centers.

2020

The projects in which Wells Fargo has invested represent 12% of all utility-scale wind and solar energy generation (by megawatt) in the U.S. from 2010 to 2020.

2021

Wells Fargo announced an agreement to meet 65% of its electricity requirements in the Philippines through purchasing geothermal power, and set a goal to deploy $500 billion in sustainable finance by 2030.

2022

Wells Fargo greatly expanded on-site solar generation assets at nearly 30 corporate and retail locations. A particular highlight was the installation of a 2 megawatt solar installation at our Jordan Creek campus in Iowa.

An off-site solar contract with Salt River Project came online in 2022, supporting Wells Fargo operations in Arizona.

Wells Fargo announced the issuance of its second Inclusive Communities and Climate Bond, a $2 billion bond that will finance projects and programs supporting housing affordability, economic opportunity, renewable energy, and clean transportation.

Employee Impact teams enabled employees to volunteer in sustainability projects in their communities.

2023

Wells Fargo held a formal groundbreaking celebration to kickoff construction of a new campus in Irvine, Texas. The campus will showcase the construction of Wells Fargo’s first Net Positive Energy buildings, meaning these offices will use renewable energy generation and energy efficiency to create more energy onsite than they consume.

2024

Wells Fargo announced a collaboration with leading energy and technology companies to offer simplified, flexible financing solutions for businesses building out charging infrastructure for electric vehicle fleets.