Serving customers since 1852

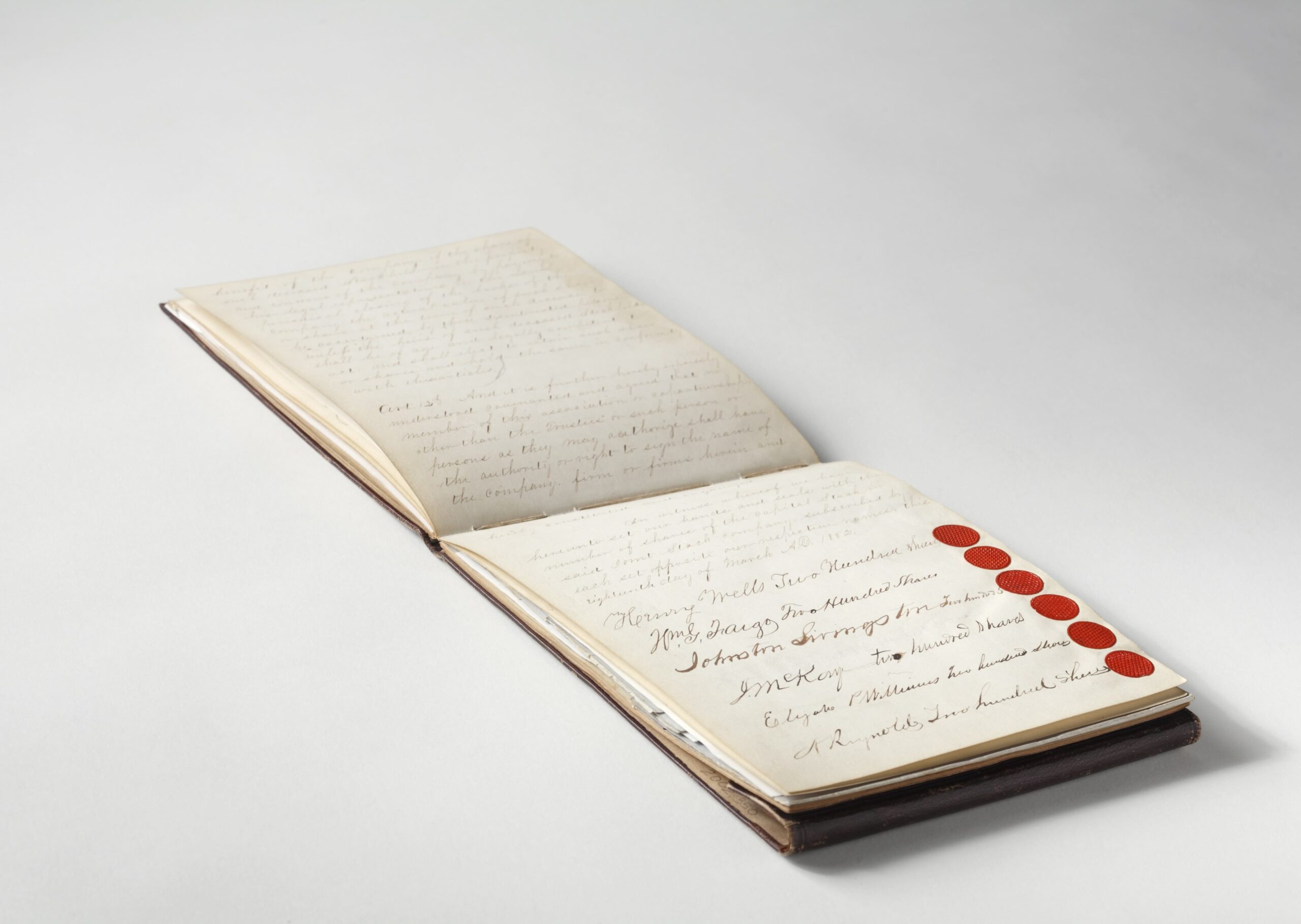

On March 18, 1852, Wells Fargo started as a bank and express company to address demand for secure payment tools at a time of technological revolution. Trains, canals, and stagecoaches created more interconnected communities and developed new industries.

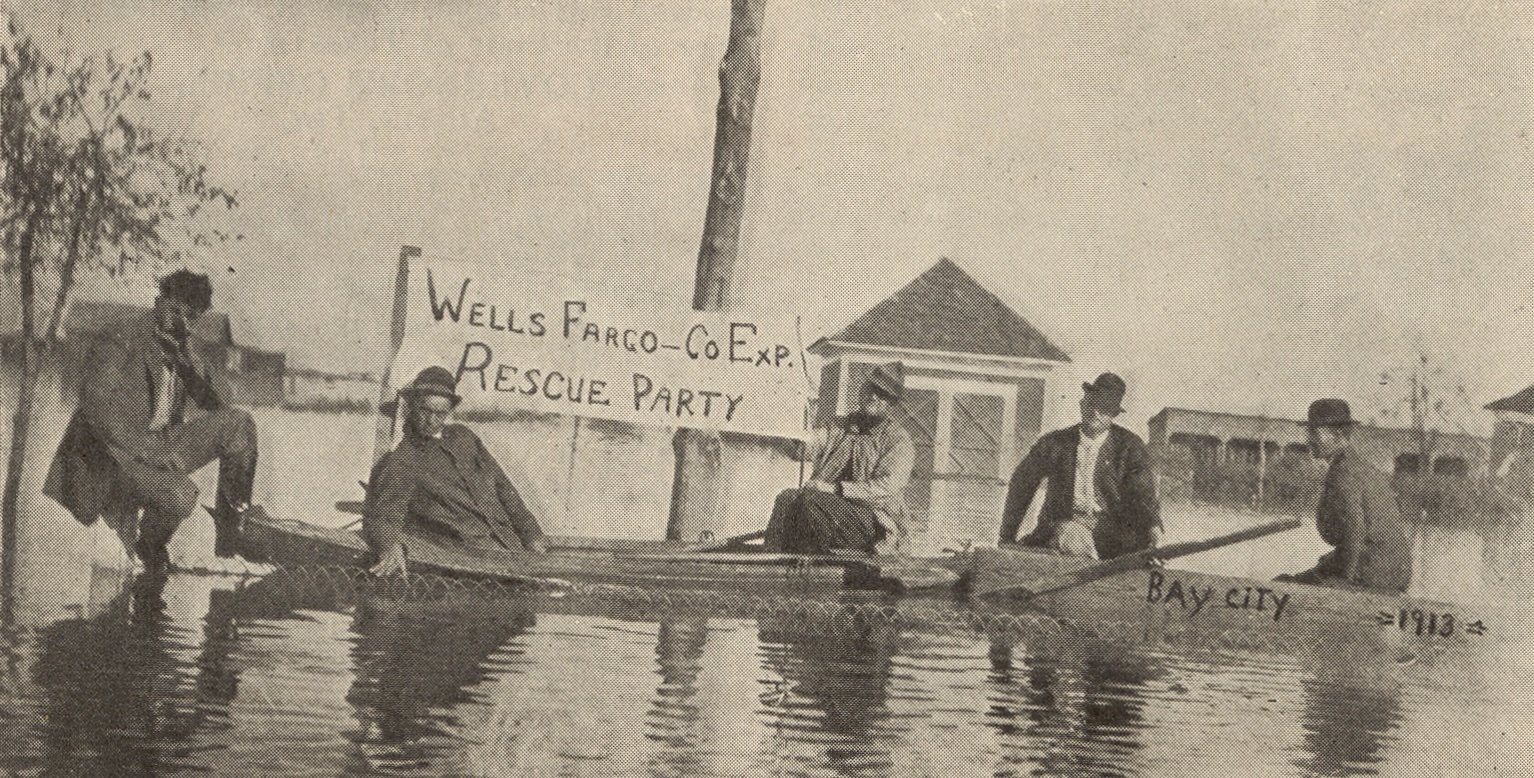

Wells Fargo’s network of express offices facilitated moving boxes of gold and silver as well as money by paper check and even “online” by telegraph. While originally intended to connect gold rush California with East Coast markets, Wells Fargo had 10,000 offices in the U.S. and around the globe by 1918.

During WWI, Wells Fargo’s express business was nationalized by the federal government for war supply mobilization. Overnight, Wells Fargo’s business pivoted to a single bank in San Francisco, California.

“Proper respect must be shown by all—let them be men, women, or children, rich or poor, white or black—it must not be forgotten that the Company is dependent on these same people for its business.”

Wells, Fargo & Co.’s Express Instruction Book, 1888

Modern Marvel

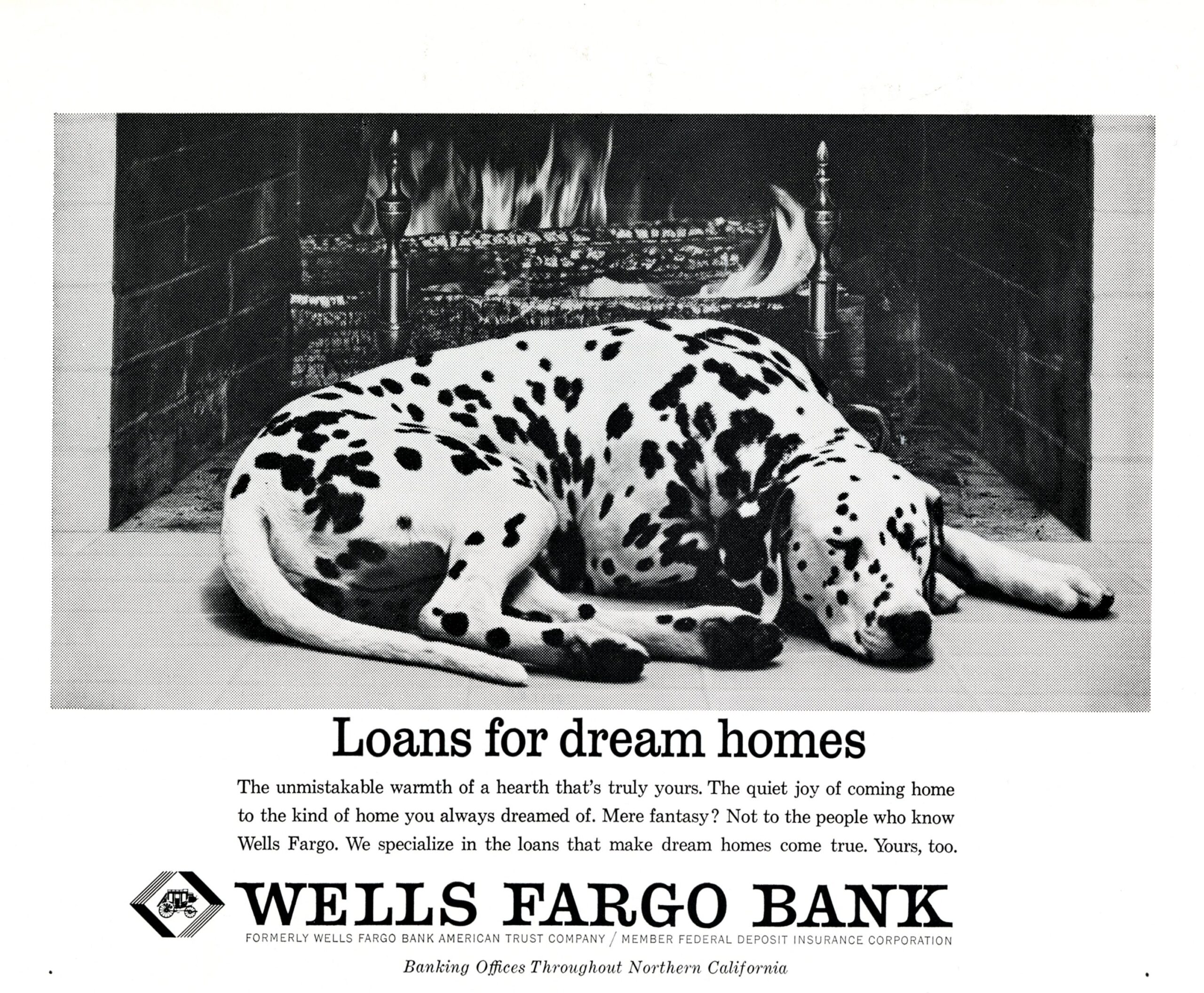

The story of our bank in the 1900s is the story of adaption and evolution into a full-service bank. It is a marvel of the modern age that you can go to one institution for a commercial loan, investment advisement, and a secure savings.

This was the dawn of a new age at the bank with an assortment of products being launched and branches opening at a rapid pace.

Powering this growth were the bank’s first computers to automate processing of an ever-increasing volume of transactions. Wells Fargo hired developers and partnered with leading minds to explore new uses of technology and developed revolutionary new innovations.

Redefining Wells Fargo

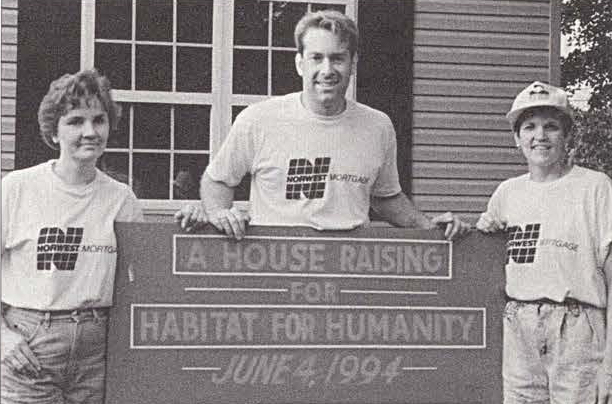

In 1995, Wells Fargo only had branches in California. Over the next dozen years, Wells Fargo continued a trend of growing a variety of banking services in more places through a series of mergers. Each institution brought under the Wells Fargo name carried its own history of community building and innovation.

In the shadow of all these mergers, Wells Fargo entered a period of transformation, a time to redefine what it meant to bank and work at Wells Fargo.

Today, we continue to look for ways to do what’s right for our customers, we seek broad impact in our communities, and we’re proud of the important role we play for our customers, our communities, and the U.S. economy.