First in online banking

Banking by floppy disk

Early computers filled entire rooms and required a dedicated team of skilled programmers to operate. By the 1980s, computers had shrunk to fit on most desks, and had evolved to become more user friendly. In California, almost 36% of people used a computer at work or home by 1989. Realizing that banking customers would start to expect their account access to extend online as well as in-person, banks started to experiment with new technologies to make banking online at home possible. Secured software on floppy disks offered some of the earliest solutions, but encrypted web-based platforms had the lasting legacy and are still used by customers today.

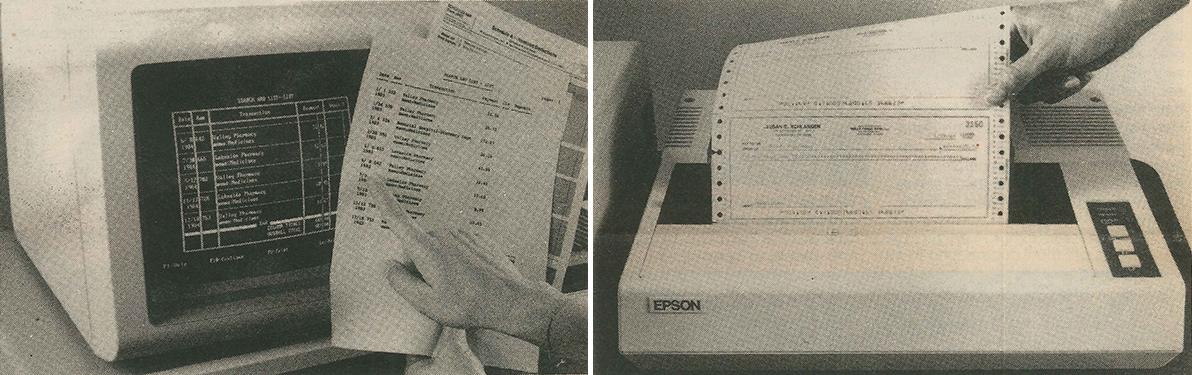

In 1984, technology company Quicken launched its new bookkeeping software. It allowed customers to keep detailed financial histories and even print checks. Wells Fargo saw the potential for customer convenience, and agreed to sell the software in its branches. Customers still had to input their transactions by hand, and there was no way for them to easily import a spreadsheet from the bank.

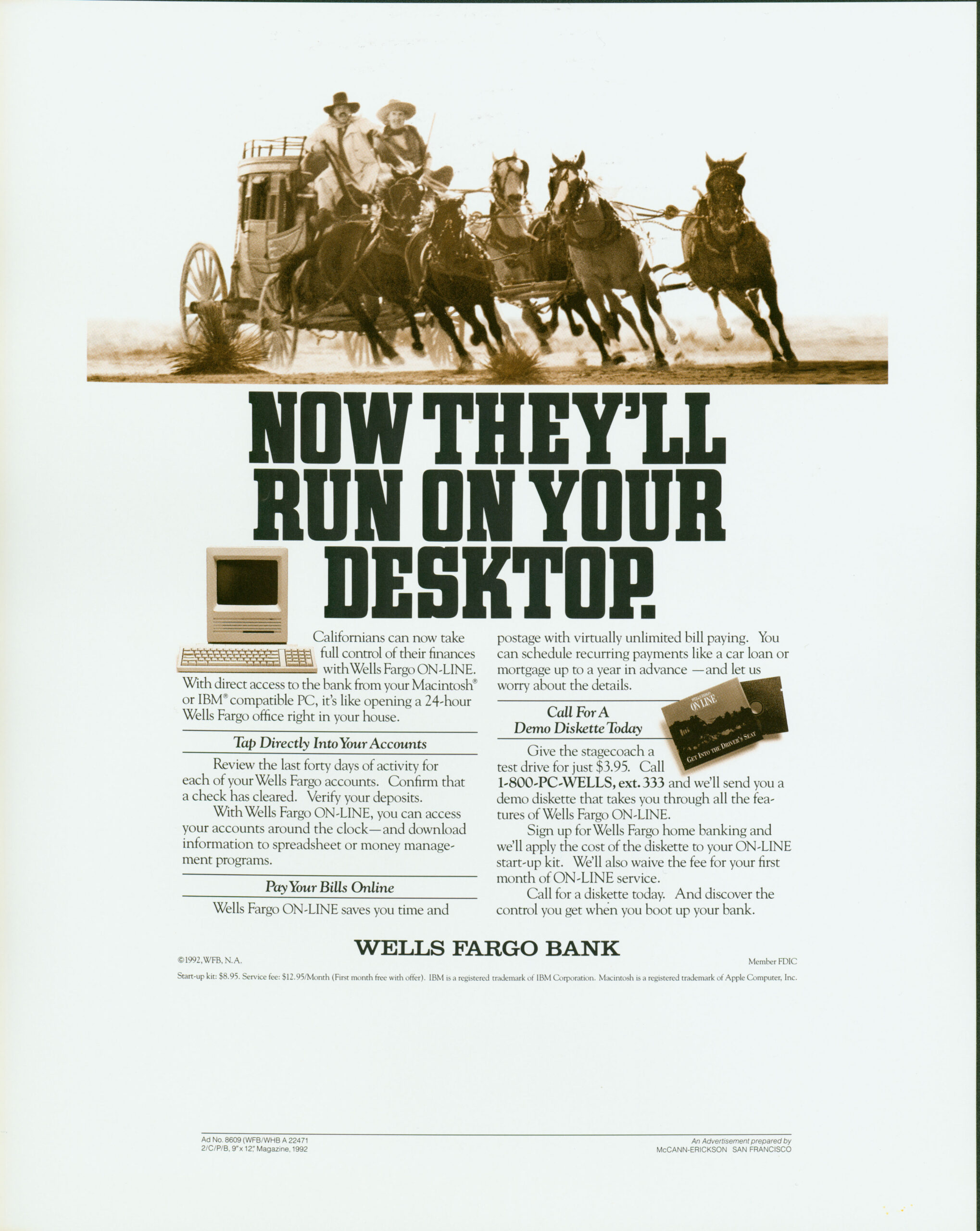

Other software companies realized that there was potential to become the platform of choice for customers to do their banking. Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems. Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time. They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature. The sophisticated system had severe drawbacks. Customers had to buy a software package and pay a monthly fee for their software’s subscription in addition to any fees charged by their bank. The interface wasn’t seamless either. Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service.

Web revolution

Meanwhile, Wells Fargo was exploring new possibilities of the internet. It launched its first website on December 12, 1994. It functioned mostly as a marketing platform by offering customers access to brochures and product descriptions. It also featured history trivia and high resolution pictures of Wells Fargo’s iconic stagecoaches.

Unfortunately, with dial-up internet access the norm, the colorful stagecoach pictures downloaded one line at a time and took several minutes to load the whole site. Customers used the built-in feedback button to submit their frustration and disappointment with the slow speed. It was one of Wells Fargo’s first learning curves in understanding customers’ expectations online. Another common question asked by customers was: When can I check my account balance on the website?

A small task force was established to take actions on building better online experiences for customers. The team built new security features and installed new servers to handle the volume of online activity. In May 1995, Wells Fargo made history again by being the first major bank to use its website as a platform for customers to access their accounts.

At first, the experience was limited to passively reviewing account activity and statements. Quickly the bank added new functions and over the next few years customers gained the ability to transfer money in between accounts, set up recurring bill payments, and more. One member of the digital team later summarized the experience: “It was a very fast implementation, and it was great for our customers, since they got value-add every six weeks or so… but it was also really great for us. We got a real sense of getting something done.”

A lasting legacy

During those first years, the website rapidly evolved as a way customers could access their account information and perform transactions. Prodigy and Quicken (now using its own website connected to the banks) continued as a customer platform into the 2000s, but the tide was turning. In the software or website debate, the website was winning, and Wells Fargo was leading the way.

In 1999, one million customers used Wells Fargo’s web platform to manage their finances, about 10% of all online banking accounts nationwide. Importantly, online banking customers weren’t just from tech savvy Silicon Valley. At the same time, Wells Fargo began banking in Oregon, Arizona, Minnesota, and other states. One customer in Oregon admitted that “If you had asked me 18 months ago would I be doing online banking and maybe bill paying I would have said no… Ironically, I am a real paper-and-pen oriented person but the debit card and online banking makes it easier to work with two people [her and her husband] on one account.”

Wells Fargo’s digital team wasn’t content with having made history developing a new way to bank. It wanted to create a place where customers could manage all aspects of their financial lives. It continued to explore and innovate. Some ideas, like offering horoscopes and used car sales alongside account histories ended quickly with little enthusiasm. Others, like merging all online accounts into one portal with one log in and mobile banking created meaningful improvements to people’s lives.

Today, the bank continues to create history as it finds new ways to help people manage their financial success.